Best Loan Calculation Tools to Buy in March 2026

Calculated Industries 3405 Real Estate Master IIIx Residential Real Estate Finance Calculator | Clearly-Labeled Function Keys | Simplest Operation | Solves Payments, Amortizations, ARMs, Combos, More

-

QUICK FINANCIAL ANSWERS: PROVIDE INSTANT LOAN OPTIONS ANYTIME, ANYWHERE.

-

PROFESSIONAL CREDIBILITY: SOLVE COMPLEX FINANCE QUESTIONS SWIFTLY TO CLOSE SALES.

-

USER-FRIENDLY INTERFACE: EASY ACCESS TO CRUCIAL REAL ESTATE FINANCE TERMS.

Victor 6500 Executive Desktop Loan Calculator, 12-Digit LCD

- EASY-TO-READ 12-DIGIT ANGLED DISPLAY FOR QUICK CALCULATIONS.

- LOAN WIZARD: SIMPLIFY COMPLEX LOAN CALCULATIONS EFFORTLESSLY.

- INPUT ANY 3 VARIABLES TO COMPUTE THE 4TH FOR PRECISE RESULTS.

Calculated Industries 43430 Qualifier Plus IIIfx Desktop PRO Real Estate Mortgage Finance Calculator | Clearly-Labeled Keys | Buyer Pre-Qualifying | Payments, Amortizations, ARMs, Combos, FHA/VA, More

- SIMPLIFIED MORTGAGE TERMS BOOST CLIENT UNDERSTANDING AND CONFIDENCE.

- FAST, ACCURATE ANSWERS ENHANCE PROFESSIONALISM AND CLOSE MORE DEALS.

- PRE-QUALIFY BUYERS EASILY, MATCHING THEM WITH AFFORDABLE OPTIONS.

Calculated Industries 3415 Qualifier Plus IIIx Advanced Real Estate Mortgage Finance Calculator | Simple Operation | Buyer Pre-Qualifying | Solves Payments, Amortization, ARMs, Combos, FHA, VA, More

- EASILY PRE-QUALIFY BUYERS FOR AFFORDABLE PROPERTY OPTIONS INSTANTLY.

- SIMPLIFY COMPLEX FINANCING AND IMPRESS CLIENTS WITH ACCURATE ANSWERS.

- ANALYZE DIVERSE LOAN TYPES AND OPTIONS WITH EFFORTLESS BUTTON PRESS.

Calculated Industries 3400 Pocket Real Estate Master Financial Calculator

- SIMPLIFY LOAN MANAGEMENT WITH INSTANT PAYMENT CALCULATIONS!

- EASILY TRACK REMAINING BALANCES AND FUTURE VALUES.

- UTILIZE DATE MATH FOR PRECISE FINANCIAL PLANNING!

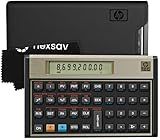

HP 12C Financial Calculator – 120+ Functions: TVM, NPV, IRR, Amortization, Bond Calculations, Programmable Keys – RPN Desktop Calculator for Finance, Accounting & Real Estate – Includes Case + Cloth

-

TRUSTED BY PROFESSIONALS SINCE 1981 FOR ACCURATE CALCULATIONS

-

OVER 120 FUNCTIONS FOR COMPREHENSIVE FINANCIAL ANALYSIS

-

RPN DESIGN FOR SWIFT AND EFFICIENT DATA ENTRY WORKFLOW

Calculated Industries 3430 Qualifier Plus IIIfx Advanced Real Estate Mortgage Finance Calculator | Clearly-Labeled Keys | Buyer Pre-Qualifying | Payments, Amortizations, ARMs, Combos, FHA/VA, More

- INDUSTRY-STANDARD KEYS SIMPLIFY MORTGAGE FINANCE CALCULATIONS.

- EASILY PRE-QUALIFY BUYERS FOR PROPERTIES THEY CAN AFFORD.

- QUICKLY ANALYZE MULTIPLE LOAN OPTIONS FOR INFORMED DECISIONS.

HP 10bII+ Financial Calculator – 100+ Functions for Business, Finance, Accounting, Statistics & Algebra – College & High School Calculator, Exam Approved for SAT, AP, PSAT – Includes Case & Cloth

- OVER 100 FUNCTIONS FOR QUICK FINANCIAL PROBLEM-SOLVING.

- APPROVED FOR SAT, PSAT, AND AP EXAMS-PERFECT FOR STUDENTS.

- USER-FRIENDLY DESIGN WITH DEDICATED KEYS FOR EFFICIENCY.

Victor 1560-6 12 Digit Heavy Duty Commercial Printing Calculator with Large Display and Loan Wizard

- LARGE DISPLAY FOR EASY READING AND ENHANCED ACCURACY IN CALCULATIONS.

- LOAN WIZARD FEATURE SIMPLIFIES FINANCIAL CALCULATIONS EFFORTLESSLY.

- HEAVY-DUTY DESIGN ENSURES DURABILITY FOR HIGH-VOLUME COMMERCIAL USE.

To calculate installment loan payments, you will first need to know the loan amount, the interest rate, and the term of the loan (the number of months it will take to repay the loan).

Next, you can use a formula to determine the monthly payment amount. This formula is:

Monthly Payment = [P * R * (1+R)^N] / [(1+R)^N - 1]

Where:

- P is the loan amount

- R is the monthly interest rate (annual interest rate divided by 12)

- N is the number of months in the loan term

Once you have these values, plug them into the formula to find the monthly payment amount. This will give you an idea of how much you will need to pay each month to repay the loan over the specified term.

What is the difference between a fixed and adjustable installment loan payment plan?

A fixed installment loan payment plan has a set monthly payment amount that remains the same throughout the life of the loan. This provides borrowers with predictability and makes it easier to budget and plan for payments.

On the other hand, an adjustable installment loan payment plan has monthly payments that can change over time based on fluctuating interest rates or other factors. This type of plan can result in lower initial payments but may also lead to higher payments in the future if interest rates increase.

Overall, the main difference between the two is the stability of the payment amount. Fixed installment loans offer predictability and consistency, while adjustable installment loans can provide flexibility but also bring potential payment fluctuations.

How to calculate installment loan payments on a personal loan?

To calculate installment loan payments on a personal loan, follow these steps:

- Determine the loan amount: Identify the total amount of the loan that you are seeking to borrow.

- Determine the interest rate: Consult with the lender to find out the interest rate at which the loan will be offered- This is typically expressed as an annual percentage rate (APR).

- Determine the loan term: Identify the length of time, usually expressed in months, over which you will be repaying the loan.

- Use a loan calculator: Use a financial calculator or an online loan calculator to input the loan amount, interest rate, and loan term. The calculator will provide you with the monthly installment amount that you will need to pay.

- Consider any additional fees: Remember to factor in any additional fees, such as origination fees or service charges, that may be associated with the loan.

By following these steps, you can accurately calculate the monthly installment loan payments on your personal loan.

What is APR and how does it affect installment loan payments?

APR stands for Annual Percentage Rate, which is the total cost of borrowing money expressed as an annual interest rate. It includes not only the interest rate on the loan, but also any fees or other charges associated with borrowing the money.

When it comes to installment loan payments, the APR can have a significant impact on how much you will end up paying over the life of the loan. A higher APR means you will pay more in interest over time, leading to higher monthly payments. On the other hand, a lower APR will result in lower monthly payments and less overall interest paid.

It's important to understand the APR when taking out an installment loan, as it can affect your overall financial situation and how much you can afford to borrow. By comparing APR rates from different lenders, you can find the best terms for your financial situation.

How to calculate installment loan payments on a home equity loan?

To calculate installment loan payments on a home equity loan, you can use the following formula:

PMT = [r(PV)] / [1 - (1 + r)^(-n)],

where: PMT = monthly payment r = monthly interest rate (annual interest rate / 12) PV = loan amount n = total number of payments

- Start by determining the loan amount (PV) and the annual interest rate for the home equity loan.

- Calculate the monthly interest rate by dividing the annual interest rate by 12.

- Determine the total number of payments (n) based on the loan term. For example, if the loan term is 10 years, the total number of payments would be 120 (10 years x 12 months).

- Plug the values of PV, r, and n into the formula to calculate the monthly payment (PMT).

- Your calculation will give you the fixed monthly installment amount that you need to pay towards your home equity loan.

What is the best way to calculate installment loan payments on a budget?

To calculate installment loan payments on a budget, you can follow these steps:

- Determine the loan amount: Start by figuring out the total amount of the loan you need. This will be the principal amount that you will be paying back in installments.

- Determine the interest rate: Find out the interest rate that is being charged on the loan. This will affect the total amount you will have to pay back over time.

- Determine the loan term: Decide how long you want to take to pay back the loan. This will impact the size of your monthly payments.

- Calculate the monthly payment: You can use an online loan calculator or a formula to determine the monthly installment payment. The formula for calculating a fixed monthly payment for an installment loan is: P = [r*PV]/[1 - (1 + r)^-n], where P is the monthly payment, r is the monthly interest rate (annual interest rate divided by 12), PV is the loan amount, and n is the number of monthly payments.

- Review your monthly budget: Make sure that the monthly installment payment fits within your budget. If it is too high, you may need to adjust the loan term or amount.

By following these steps, you can calculate installment loan payments on a budget and ensure that you can make your payments comfortably each month.