Best Small Loans to Buy Sports Gear in February 2026

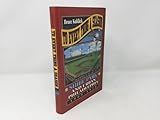

To Every Thing a Season: Shibe Park and Urban Philadelphia, 1909-1976

Bandit Walleye Deep - Loan Shark

- DEPTH-TROLLING DESIGN REACHES 27 FEET FOR EFFECTIVE FISHING.

- PROVEN SUCCESS FOR WALLEYE, ZANDER, AND PREDATOR GAMEFISH.

- EXPERT-DESIGNED WITH DURABLE, TRUE-RUNNING MOLDED-IN LIP.

TECEUM 2 Inch Webbing – Honey Yellow – 25 Yards – 2” Heavy-Duty Wide Webbing for Climbing Outdoors Indoors Crafting DIY nw

-

DURABLE & VERSATILE: IDEAL FOR OUTDOOR ACTIVITIES AND CRAFTING!

-

EXTRA-STRONG WEBBING: WATER AND UV-RESISTANT FOR LASTING USE!

-

VIBRANT OPTIONS: AVAILABLE IN 35+ COLORS AND VARIOUS LENGTHS!

BANDIT LURES Multi-Species Minnow Jerkbait Glowing Fishing Lure, Fishing Accessories, Excellent for Bass and Walleye, 4 5/8", 3/4 oz, Loan Shark

-

DUAL GLOW STICK SLOTS BOOST VISIBILITY TO ATTRACT FISH FROM AFAR.

-

IRRESISTIBLE FLASH TRIGGERS MASSIVE STRIKES EVEN IN LOW-LIGHT CONDITIONS.

-

PROVEN BANDIT WALLEYE DEEP DESIGN ENHANCES WOBBLE AND SWIMMING ACTION.

If you are looking to get a small loan for buying sports equipment, there are a few options you can consider. One option is to look into personal loans from financial institutions or online lenders. These loans can be used for various purposes, including purchasing sports equipment. Another option is to look into specialty sports financing companies that offer loans specifically for sports equipment purchases.

Before applying for a loan, it's important to determine how much money you need and how you plan to repay the loan. You should also check your credit score to see if you qualify for a loan and compare interest rates and terms from different lenders to find the best option for your needs. Additionally, you may want to consider using a co-signer or collateral to increase your chances of getting approved for a loan.

What is the likelihood of approval for a small loan with a cosigner?

The likelihood of approval for a small loan with a cosigner will depend on the creditworthiness of the cosigner. If the cosigner has good credit and a stable financial history, the chances of approval for the loan will be higher. The financial institution will assess both the borrower and the cosigner's credit history, income, and overall financial stability before deciding whether to approve the loan. Having a cosigner with good credit can improve the chances of approval for the loan.

What is the average term length for a small loan?

The average term length for a small loan typically ranges from a few months to a few years, depending on the lender and the amount borrowed. However, the most common term length for a small loan is between 6 months to 2 years.

What is the repayment schedule for a small loan?

The repayment schedule for a small loan can vary depending on the terms set by the lender. Typically, small loans are repaid in regularly scheduled installments over a set period of time, such as weekly, bi-weekly, or monthly. The frequency of payments and the total number of payments will be outlined in the loan agreement. The amount of each installment will include both the principal amount borrowed and any interest or fees charged by the lender. It's important to carefully review and understand the repayment schedule before agreeing to a loan to ensure you can comfortably make the payments on time.