Best Vortex Indicator Tools to Buy in February 2026

DAY TRADING USING CENTRAL PIVOT RANGE (CPR), VOLUME WEIGHTED MOVING AVERAGE, ADX/DMI & VORTEX INDICATOR

Mini Vortex Mixer, 3500rpm Lab Vortex Shakers with Touch Function LED Indicator Vortex Paint Mixer for Nail Polish Ink Eyelash Adhesives Test Tubes Vortex Mixing and Acylic Paint Orange

- POWERFUL 3500RPM MOTOR MIXES IN JUST 3 SECONDS-EFFICIENT RESULTS!

- ULTRA-LIGHTWEIGHT AT 0.22KG, EASY TO CARRY AND USER-FRIENDLY OPERATION.

- ANTI-SLIP DESIGN MINIMIZES NOISE AND VIBRATION FOR STABLE MIXING.

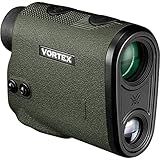

Vortex Triumph HD 850 Laser Rangefinder

-

ACCURATE READINGS UP TO 850 YARDS FOR PRECISION IN DEER HUNTING.

-

PREMIUM OPTICAL SYSTEM ENSURES SHARP, TRUE-COLOR VISUALS.

-

LIFETIME WARRANTY GUARANTEES PEACE OF MIND ON YOUR INVESTMENT.

Vortex Optics Crossfire HD 1400 Laser Rangefinder

- LIGHTWEIGHT AT 4.8 OZ-IDEAL FOR BOWHUNTERS AND ULTRALIGHT PACKS.

- HD OPTICS WITH XR COATINGS ENSURE PEAK CLARITY AND LOW LIGHT PERFORMANCE.

- LIFETIME VIP WARRANTY GUARANTEES REPAIR OR REPLACEMENT OF DEFECTS.

Vortex Optics Diamondback HD 2000 Laser Rangefinder

- RANGE UP TO 2,000 YARDS: PERFECT FOR MIDWEST AND GREAT PLAINS HUNTING!

- HD OPTICAL SYSTEM: EXCEPTIONAL RESOLUTION AND LOW LIGHT PERFORMANCE.

- DURABLE DESIGN: WATERPROOF, SHOCKPROOF, AND BACKED BY A LIFETIME WARRANTY!

Vortex Optics Riflescope Pro Leveling Kit

- ACHIEVE FLAWLESS RETICLE ALIGNMENT WITH DUAL LEVEL ACCURACY.

- SIMPLIFIED SETUP: ONE-HANDED OPERATION ELIMINATES GUESSWORK.

- DURABLE 6061 ALUMINUM CONSTRUCTION, BACKED BY A LIFETIME WARRANTY.

Vortex Optics Crossfire Red Dot Sight Gen II- 2 MOA Dot (CF-RD2)

- 50,000-HOUR BATTERY LIFE: RELIABLE PERFORMANCE IN ANY CONDITION.

- 11 ILLUMINATION SETTINGS: PERFECT DOT INTENSITY FOR ANY LIGHTING.

- LIFETIME VIP WARRANTY: UNMATCHED ASSURANCE FOR PEACE OF MIND.

The Vortex Indicator is a technical analysis tool used to identify the beginning of a new trend or trend reversal in the financial markets. It was developed by Etienne Botes and Douglas Siepman to capture both the positive and negative directional movement in a security's price.

The Vortex Indicator consists of two lines: the positive vortex line (VI+) and the negative vortex line (VI-). These lines represent the upward and downward price movements over a certain period, typically 14 days.

To interpret the Vortex Indicator, traders focus on the interactions between the VI+ and VI- lines. When the VI+ line crosses above the VI- line, it suggests a bullish trend, indicating positive upward price movement. Conversely, when the VI- line crosses above the VI+ line, it indicates a bearish trend, signifying negative downward price movement. These crossover points act as potential entry or exit signals for traders.

Furthermore, the Vortex Indicator's values can be used to determine the strength of a trend. Higher values of both VI+ and VI- indicate stronger trends, while lower values suggest weaker trends or potential consolidation. Traders may look for confirmation from other technical indicators or chart patterns to avoid false signals.

In addition, the Vortex Indicator can be combined with other technical analysis tools, such as moving averages or support and resistance levels, to enhance its effectiveness. Some traders also use this indicator to identify potential trend reversals when the VI+ and VI- lines cross each other within a short timeframe.

Like any technical indicator, the Vortex Indicator is not perfect and should be used in conjunction with other analysis techniques and risk management strategies. It is essential to thoroughly understand and test the indicator before incorporating it into your trading strategy.

How to use the Vortex Indicator for risk management?

The Vortex Indicator is a technical analysis tool used to identify the direction of the trend and provide signals for potential changes in price direction. While it is primarily used for trend identification, it can also serve as a risk management tool when combined with other indicators and strategies. Here are some ways to use the Vortex Indicator for risk management:

- Trend identification: The Vortex Indicator consists of two lines – the Positive Vortex Indicator (VI+) and Negative Vortex Indicator (VI-). When the VI+ line is above the VI- line, it indicates an uptrend, while a VI- line above the VI+ line suggests a downtrend. By identifying the trend, you can manage risk by aligning trading decisions with the prevailing market direction.

- Confirming price movements: The Vortex Indicator can help confirm price movements and assess the strength of a trend. If the Vortex Indicator aligns with other indicators or price action signals, it can provide a higher probability of success when entering or exiting trades. This confirmation can help you manage risk by increasing the probability of being on the right side of the trade.

- Signal confirmation: The Vortex Indicator generates signals when the VI+ or VI- crosses above or below a set level, typically depicted as horizontal lines on the indicator. These crossovers can be used to confirm other signals generated by indicators or strategies. By waiting for the Vortex Indicator to confirm a signal, you can reduce the risk of false signals and potentially avoid entering losing trades.

- Stop-loss placement: The Vortex Indicator can assist in determining optimal stop-loss levels. For example, if the Vortex Indicator suggests an uptrend and you have entered a long position, you could place a stop-loss order below the recent swing low or a specific percent below the entry price. This can help limit potential losses if the trend reverses or unexpected market conditions arise.

- Trade timing: The Vortex Indicator can assist in identifying optimal entry and exit points by signaling potential trend reversals. By waiting for a crossover or divergence between the two lines, you can time your entries or exits with higher precision, improving risk management by reducing the chances of entering trades too early or exiting too late.

Remember, risk management should involve using multiple indicators, strategies, and tools in conjunction with the Vortex Indicator. Always consider other technical analysis tools, fundamental analysis, and market conditions when making trading decisions.

What are the key differences between the Vortex Indicator and the Average Directional Index (ADX)?

The key differences between the Vortex Indicator and the Average Directional Index (ADX) are as follows:

- Calculation Methodology: The Vortex Indicator calculates the true range and directional movement for each trading period, while the ADX calculates the average of the true range over a specified period.

- Focus: The Vortex Indicator focuses on the directional movement, helping traders identify trends and the strength of those trends. On the other hand, the ADX focuses on the strength of the trend irrespective of its direction.

- Indicator Values: The Vortex Indicator provides two lines, the +VI (Vortex Indicator Plus Directional Movement) and -VI (Vortex Indicator Minus Directional Movement), representing positive and negative price movement, respectively. These lines can be used to identify the direction of the trend. The ADX, on the other hand, provides a single line that represents the strength of the trend.

- Range: The Vortex Indicator ranges between -1 and +1, where values above 0.5 indicate a positive trend, and values below -0.5 indicate a negative trend. The ADX ranges from 0 to 100, where values above 25 generally indicate a trending market and higher values represent stronger trends.

- Complementary Indicators: The Vortex Indicator is often used in conjunction with the ADX to identify the strength and direction of a trend. While the Vortex Indicator focuses on price movement, the ADX provides an additional measure of trend strength.

- Interpretation: The Vortex Indicator is better suited for identifying the direction of the trend and potential trend reversals, while the ADX is useful in determining the strength of the trend and potential periods of consolidation.

Overall, the Vortex Indicator and the ADX are complementary tools that can be used together to gain a more comprehensive understanding of price trends and their strength.

What is the historical performance of the Vortex Indicator?

The Vortex Indicator is a technical analysis tool that was developed by Etienne Botes and Douglas Siepman in 2010. It is used to identify the direction of a trend and to determine if it has a strong or weak momentum. The historical performance of the Vortex Indicator has been widely variable and depends on the specific asset or market being analyzed.

When applied correctly, the Vortex Indicator can effectively capture trend movements and help traders identify potential buying or selling opportunities. However, like any other technical indicator, it should not be solely relied upon for decision-making. It is important to use the Vortex Indicator in conjunction with other indicators, chart patterns, and fundamental analysis to enhance accuracy and evaluate market conditions comprehensively.

The performance of the Vortex Indicator also depends on the timeframe being used. Some traders may find it more reliable on shorter timeframes for intraday trading, while others may find it more effective on longer timeframes for swing or position trading.

Overall, it is crucial to backtest and evaluate the performance of the Vortex Indicator within the context of specific markets and trading strategies before making any trading decisions. Additionally, it is recommended to practice risk management and exercise caution when using any technical indicator in trading.

What is the Vortex Indicator and its purpose in trading?

The Vortex Indicator is a technical analysis tool used in trading to identify the direction of price movement and determine trend reversals. It was developed by Etienne Botes and Douglas Siepman and introduced in their book "The New Science of Technical Analysis" in 2008.

The purpose of the Vortex Indicator is to capture the positive and negative trend movements of an asset by comparing the current high and low prices with the previous ones. It consists of two lines: the Positive Vortex line (VI+) and the Negative Vortex line (VI-). These lines can be plotted on a price chart to show the strength and direction of a trend.

When the VI+ line crosses above the VI- line, it indicates a bullish trend, suggesting that buyers are dominating the market. Conversely, when the VI- line crosses above the VI+ line, it suggests a bearish trend, indicating that sellers have taken control. Additionally, when the two lines converge and cross each other, it signals a potential trend reversal.

Traders can use the Vortex Indicator to confirm the strength of an ongoing trend, identify trend changes, and generate buy or sell signals. It can be applied to various time frames and different trading instruments such as stocks, commodities, or currencies. However, it is essential to use the Vortex Indicator in conjunction with other technical indicators and analysis tools to make informed trading decisions.

How to interpret the Vortex Indicator in different market conditions?

The Vortex Indicator is a technical analysis tool that helps traders identify the trend and gauge the volatility in the market. It consists of two lines, the positive trend indicator (VI+) and the negative trend indicator (VI-), along with an average line (AVD). Here's how to interpret the Vortex Indicator in different market conditions:

- Trending market: Strong uptrend: If the VI+ line is consistently above the VI- line and both lines are above the AVD line, it indicates a strong uptrend. Traders may consider buying opportunities in this scenario. Strong downtrend: If the VI- line is consistently above the VI+ line and both lines are below the AVD line, it suggests a strong downtrend. Traders may consider selling or shorting opportunities in this scenario.

- Ranging market: Choppy market: When both the VI+ and VI- lines are close to each other and crisscross around the AVD line, it indicates a lack of a clear trend. Traders should be cautious and may consider avoiding trading during this period. Sideways market: If both the VI+ and VI- lines are close to the AVD line, it suggests sideways or range-bound market conditions. Traders may consider using other technical indicators or patterns to identify potential breakouts or reversals.

- Volatility: Increasing volatility: When the VI lines widen, it suggests an increase in market volatility. Traders may consider adjusting their trading strategies to account for larger price swings and potential breakouts. Decreasing volatility: If the VI lines converge and become narrower, it indicates a decrease in volatility. Traders may consider using risk management techniques like tightening stop-loss orders or reducing position sizes.

It's important to note that the Vortex Indicator should not be used in isolation but in conjunction with other technical analysis tools to confirm signals and make informed trading decisions. Traders should also consider the overall market conditions, news events, and other factors that may impact the market.